Not Designated as Hedging Instrument Trading. Such as risk components of non-financial items that can be designated in hedging relationships.

Chain Link Hedge Slats 10 Year Warranty Chain Link Fence Privacy Fence Designs Fence

I would like to clarify that my personal representative under my will would have until 1231 of the year after my death to split the IRA in two separate IRAs where one of the new IRAs listed my son as the sole beneficiary making.

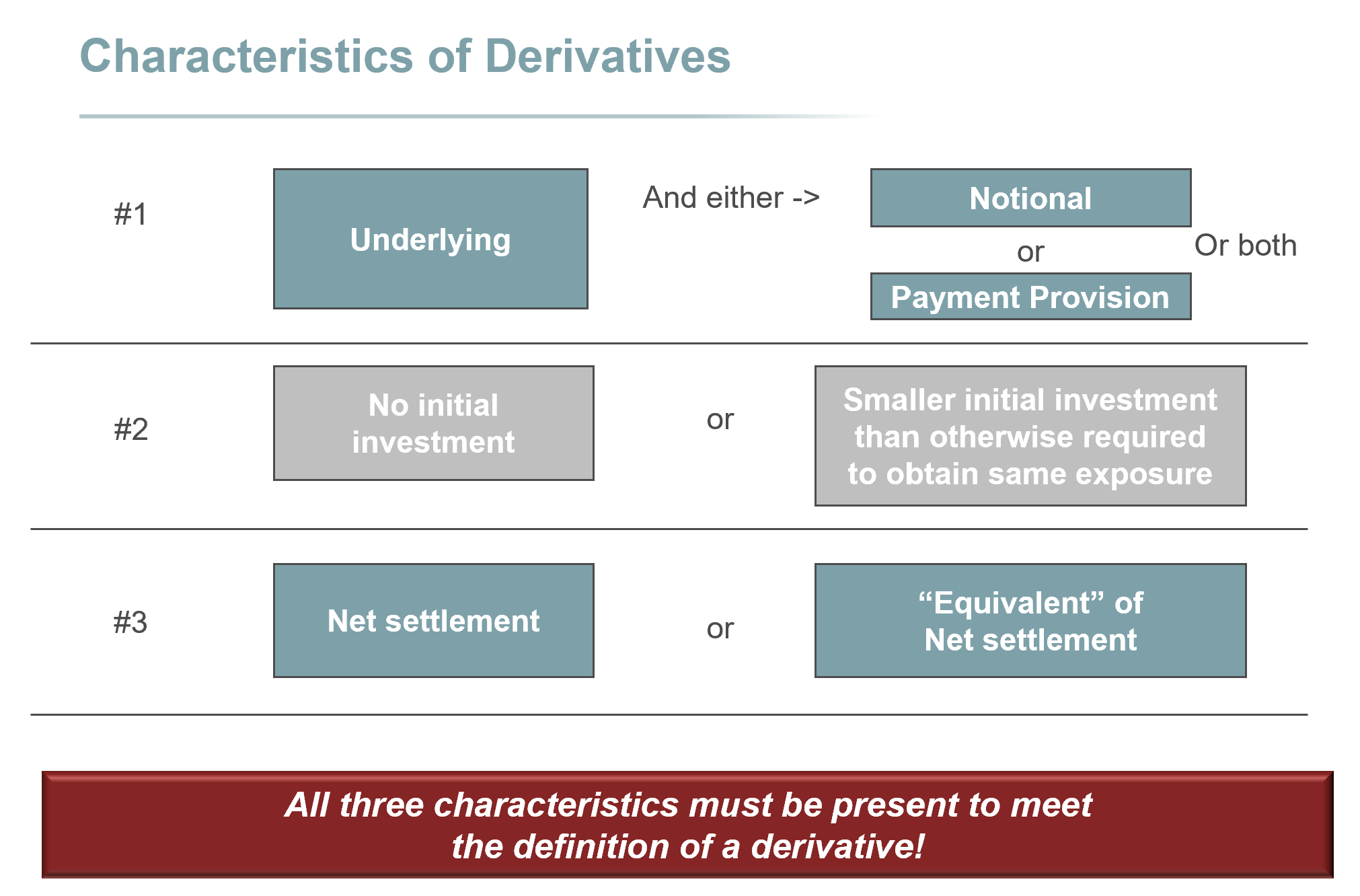

. IFRS 9 changed the accounting requirements on using purchased options as hedging instruments. Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any Subsidiary is a party and as to which at the time such Hedge Agreement is entered into a Lender or any of its Affiliates is a. Non-designated heritage assets are buildings monuments sites places areas or landscapes identified by plan-making bodies as having a degree of heritage significance meriting consideration in planning decisions but which do not meet the criteria for designated heritage assets.

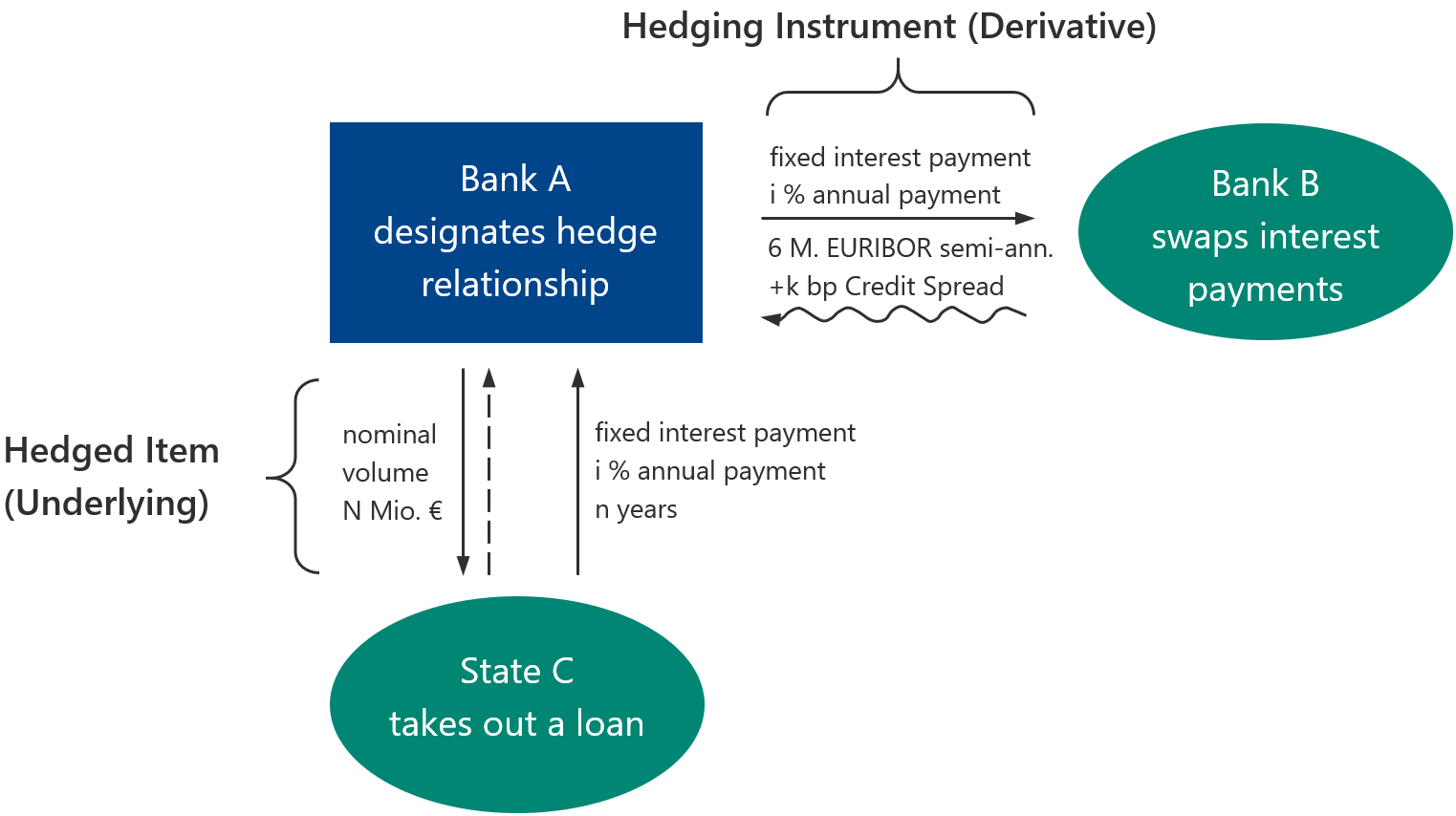

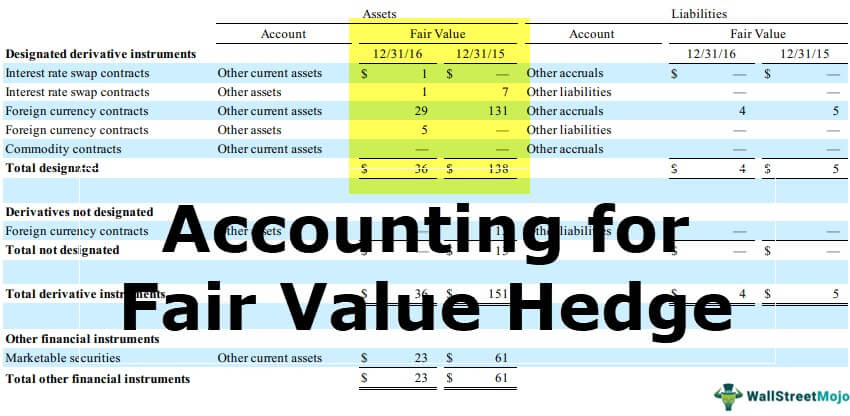

Introduction 2 12 The main changes in the IFRS 9 hedge accounting requirements 3 2 Risk management 4. For a fair value hedge the offset is achieved either by marking-to-market an asset or a liability which offsets the PL movement of the derivative. On the other hand a Designated Agency firm appoints a particular agent to a client.

As of June 30 2012 the total notional amounts of designated and non-designated equity contracts purchased and sold were 14 billion and 982 million respectively. And ongoing monitoring of designated hedges. Designated Hedges means any Hedge entered into by the Company that meets the parameters set forth on Schedule A including any Hedge entered into in accordance with the terms set forth in Section 61 b v.

Not Designated as Hedging Instrument Economic Hedge. It views a purchased option as similar to purchasing insurance cover with the time value being the associated cost. No Obligations under any Designated Hedge Agreement or Designated Cash Management Services Agreement will.

From time to time to hedge our price risk we may use and designate equity derivatives as hedging instruments including puts calls swaps and forwards. There are two types of hedge recognized. Designated vs non designated hedge Written By brandonriblet30312 Wednesday June 8 2022 Add Comment Edit Hedge accounting is an accountancy practice the aim of which is to provide an offset to the mark-to-market movement of the derivative in the profit and loss account.

In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting hedges. 3 a new. I have Designated son and Non-Designated Beneficiaries 3 charities to my traditional IRA.

These nonperson entities are subject to different withdrawal. Again thats the definition in IAS 39 and IFRS 9. 1 the substantial cost of documentation and ongoing monitoring of designated hedges.

A not designated beneficiary is a classification for certain nonperson entities who inherit a retirement account. If an entity elects to designate only the intrinsic value of the option as the hedging instrument it must account for the changes in. Such as risk components of non-financial items that can be designated in hedging relationships.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip. The ongoing development. In theory no conversations can take place at the water cooler for example that.

Examples of Designated Hedge Agreement in a sentence. Therefore Entity A qualifies to use the shortcut method. Designated Vs Non Designated Hedge.

The results suggested that the way. 2 the availability of natural hedges that can be highly effective. The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting.

What is a Non-Designated Heritage Asset. 2 the availability. Designated Hedges means the agreements specified in the Indenture and.

If the company has a designated fair value hedge where the hedged item is taxed in line with its accounting treatment the tax treatment of the derivative is to simply. IRA Discussion Forum. February 2014 Hedge accounting under IFRS 9 1 Contents 1.

Derivative instrument not designated as hedging instrument under Generally Accepted Accounting Principles GAAP used as economic hedge for exposure to risk. For tax purposes companies can designate derivatives as hedging transactions. 2 the availability of natural hedges that can be highly effective.

An example is a gift to a special scholarship fund at a university. Cannot be designated as a hedged item IAS 39 Fair value hedges non derivative from ACCT 4010 at HKUST. A Non-Designated Agency real estate firm owes a duty of loyalty to a client which is shared by all agents of the firm.

Its pretty straight forward and very easy to understand. Designated Vs Non Designated will sometimes glitch and take you a long time to try different solutions. If required by the Majority Lenders the Borrowers shall promptly execute a Security Document granting a Security Interest in respect of all of its right title and interest in such Designated Hedge Agreement.

For financial entities the situation is more complex. With a unique set of microchannel condensers an experimental comparison between subcooling generated in non-designated area NDA and designated area DA of the condenser showed that both configurations yielded similar values of maximum COP improvement within the operating ie 2 conditions considered. Hedge accounting is an accountancy practice the aim of which is to provide an offset to the mark-to-market movement of the derivative in the profit and loss account.

The effectiveness of a hedge for tax purposes is merely a matter of whether the gain or loss generated by the hedging transactions has the same income tax treatment as the underlying hedged business transactions and thus is used to offset the income tax effect. LoginAsk is here to help you access Designated Vs Non Designated quickly and handle each specific case you encounter. Designated Hedges has the meaning given in clause 61.

Cash flow hedge is a hedge of the exposure to variability in cash flows that is attributable to a particular risk associated with all or a component of a recognized asset or liability or a highly probable forecast transaction and could affect profit or loss.

Css Zen Garden Home Page Maquette Desktop Css Zen Garden Zen Garden Mini Zen Garden

Hedge Accounting Part 1 Prospective Testing And The Risk Induced Fair Value Finbridge Gmbh Co Kg

How Is A Hedge Of Interest Rate Risk Impacted Kpmg Global

Derivatives And Hedging Gaap Dynamics

6 2 Eligibility Criteria Hedges Of Financial Assets And Liabilities

Accounting For Fair Value Of Hedges Examples Journal Entries

0 comments

Post a Comment